NPS in 2015 Part III: Entertainment & Telecommunications

For the final installment in our series on the latest changes from the 2015 US Consumer NPS study, I’ll be covering the shifts we’re seeing within the telecommunications and entertainment industries.

Part 1 covered the finance and retail sectors, while Part 2 looked at tech and travel companies.

The Satmetrix US Consumer Net Promoter study is now in its 15th year, and 2015 was our largest study to date! Covering over 220 different brands in 22 different sectors, we collected more than a million data points from over 30,000 individual US consumers.

The Decline of the Telco

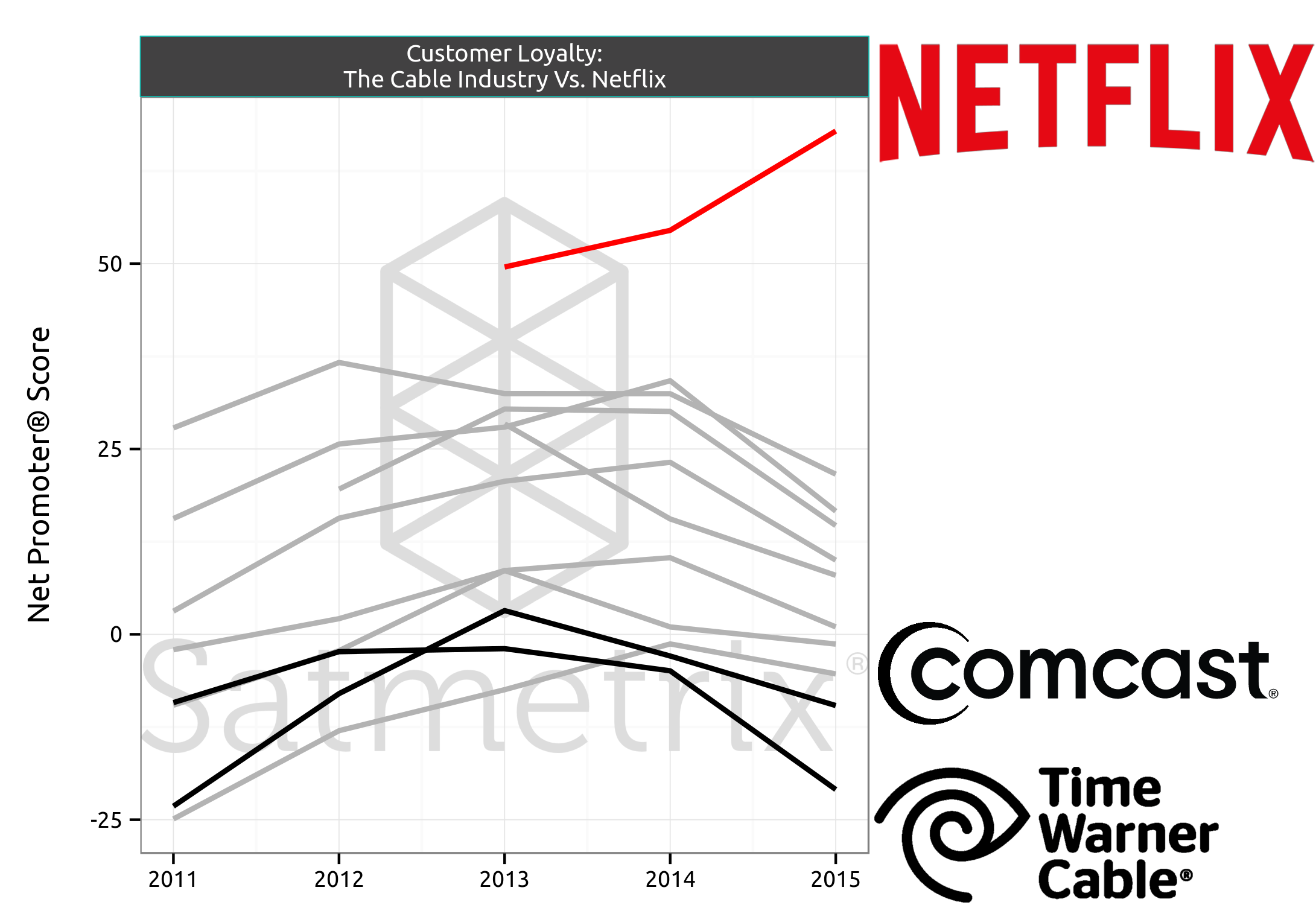

American consumers do not like their telecommunications companies. The sector with the lowest average NPS has been internet service providers for the last five years, with the same names in cable just behind them. The single worst performing company in the entire study has been an telco for 12 of the last 15 years.

Loyalty has gone from bad to worse for American telcos; the cable and ISP sectors saw the largest drops in our US study this year, with cable companies falling over 10pts on average. For some context, credit card companies fell an average of 9pts during the height of the financial crisis.

The Battle for the Customer Interface

The number of American households which are ‘cutting the cord’ – watching video content solely via the Internet – is on the increase. The last major survey found that around 7.6 million US households fell into this category in 2014, although the rate at which consumers are forgoing cable subscriptions is estimated to be increasing rapidly.

Perhaps unsurprisingly, one of the factors most predictive of cutting the cord is having a Netflix account.

Could telecommunications companies soon become nothing more than ‘dumb data pipes’: commodity infrastructure, delivering content to users they bought elsewhere?

Not this year. Current estimates put households who have ‘cut the cable cord’ at just 7.3%. But looking at signals from the industry and our own Net Promoter research, Netflix have positioned themselves superbly to accelerate and profit from the shift.

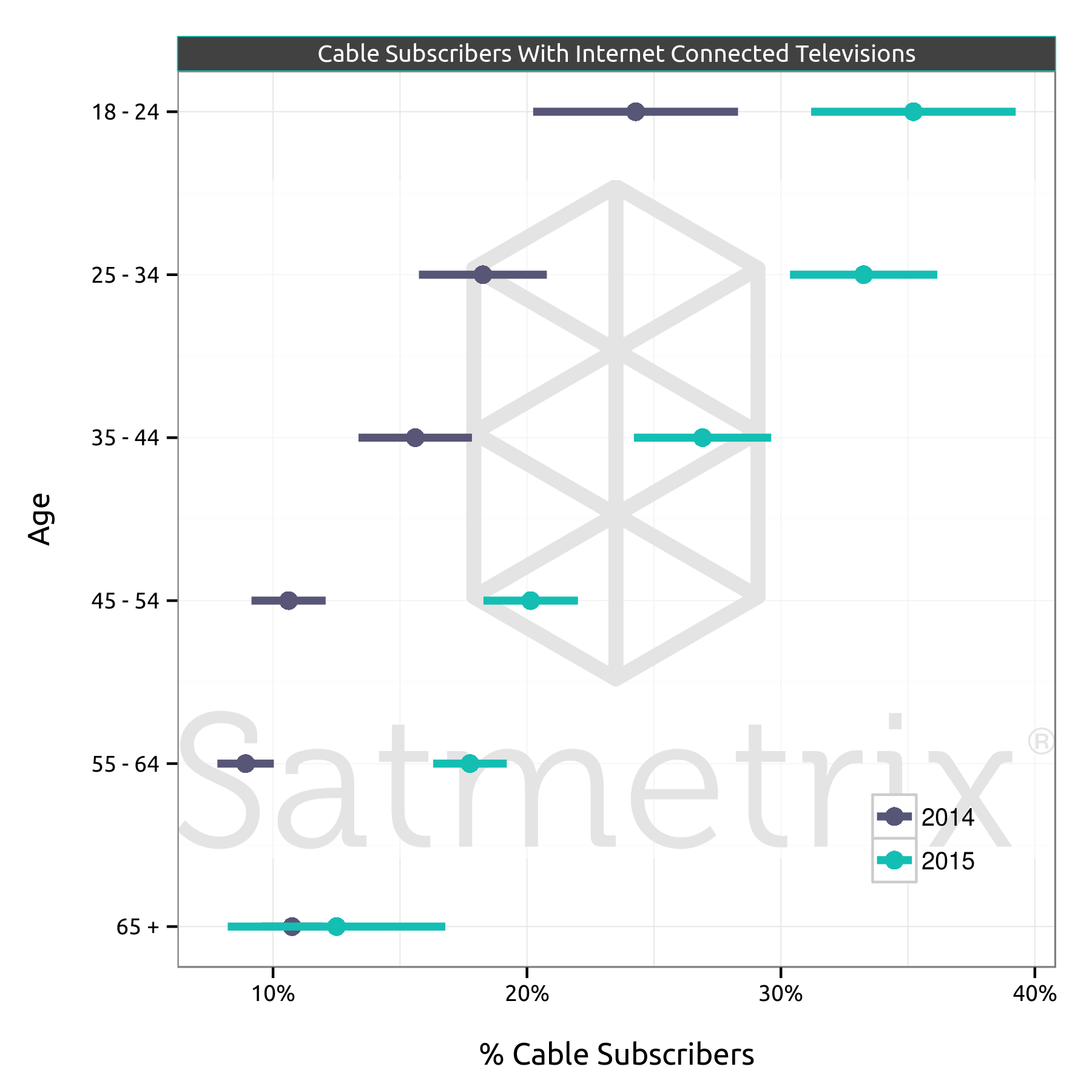

Watching TV without cable used to be an active choice: you needed to buy a device that connected to the Internet and your television. The number of options increased bewilderingly, from games consoles and set top boxes to WiFi enabled Blu-Ray players, all of which required more tinkering, and yet more remotes. For a long time, the games console was the primary device (along with its skewed demographic profile). However, rapidly increasing sales of ‘Smart TVs’ – Internet connected by default – means that many consumers who are buying a new set will have everything they need to cut the cord, whether they know it or not.

This matters to the cable companies, not just because more customers have the means to abandon them. It represents a fundamental shift in the control of the customer interface. The television set itself, not the cable box, increasingly provides the menu from which consumers select what they’d like to watch. That menu is more like an iPhone than an infinite Gantt-chart of linear content. As we know from other industries becoming ‘appified’, if the logo in your allotted square doesn’t communicate snappy user experience (and a clear value proposition), you’re unlikely to draw the ‘clicks’, and the resulting business.

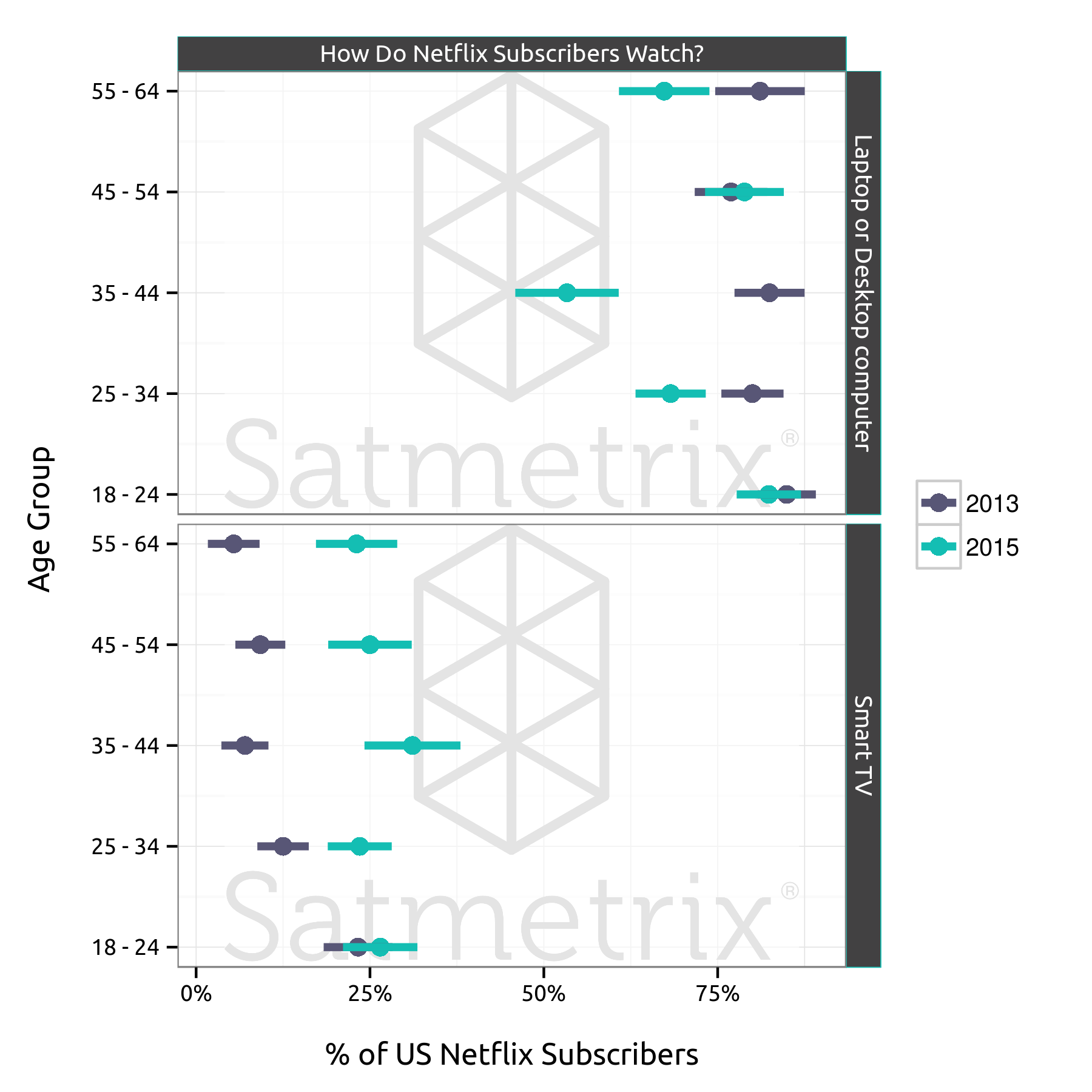

What surprised me about the results from our Online Entertainment study was how much ground Netflix have left to take from their existing subscribers. Only a quarter are currently watching the service through a smart TV (the figures aren’t much higher for set-top boxes), with three quarters watching the service using a traditional computer.

Previous research has characterized cord-cutters as tech-savvy millennials, watching services on the devices where they spend time (laptops and phones). With Netflix et al available from the couch, the demographics of cord-cutting are likely to get broader. While we saw increases this year in Netflix subscribers viewing via Smart TVs (at the expense of computers), we saw the biggest swing not in millennials, but 35 to 44 year olds. It may well be that the ‘second wave’ of cord-cutters isn’t just the young.

Cable companies are failing by their own measures of success

Viewing Across Devices

“We believe in unification of experiences across devices”

May 24, 2012. Matt Strauss, SVP, Digital and Emerging Platforms, Comcast

While the rise of Smart TVs is likely to a broaden the demographic of cord-cutters, it’s not the only device that matters. In order to appeal to a wide range of consumers, entertainment services need to be available and consistent across the devices their subscribers are on.

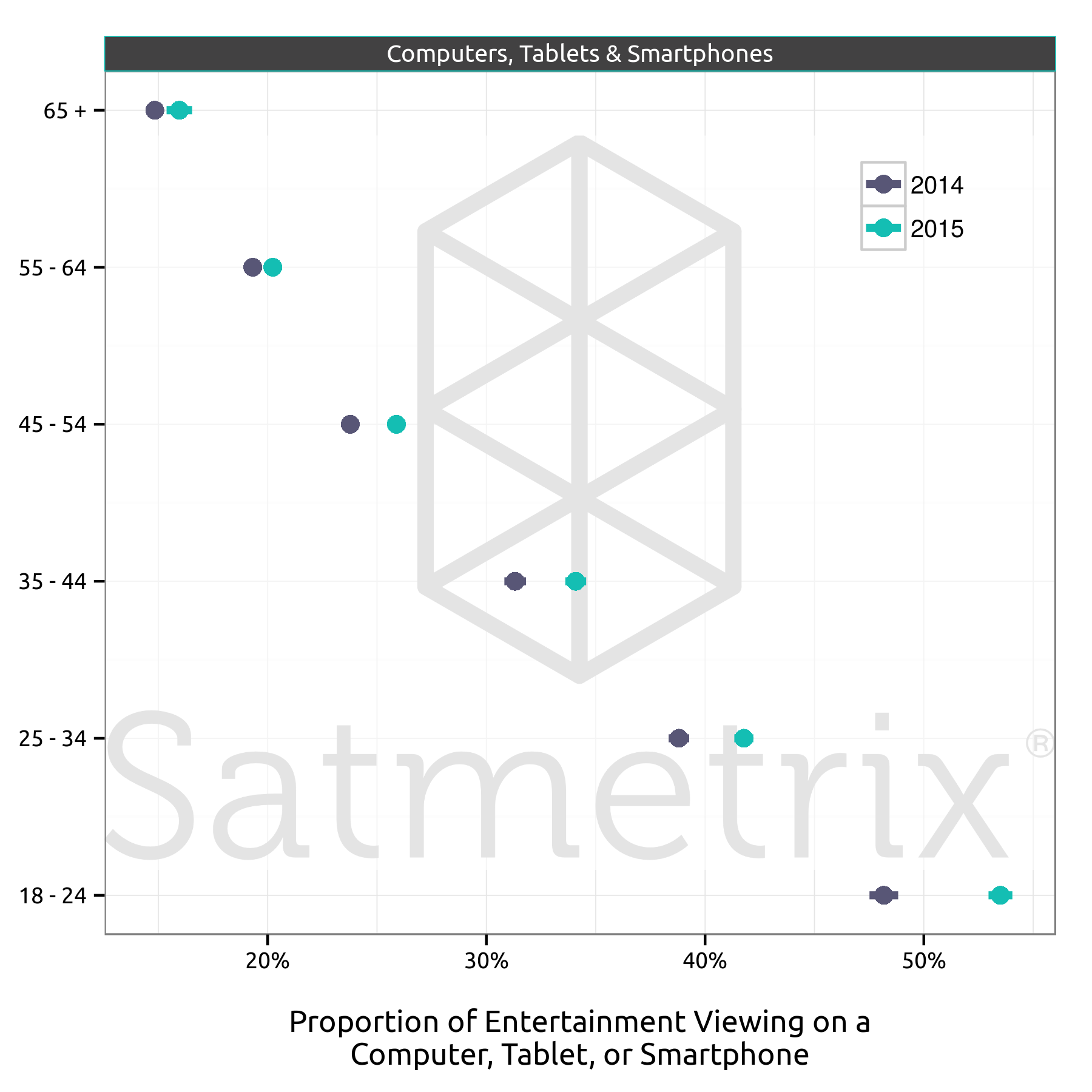

Perhaps unsurprisingly, the young watch the largest proportion of video entertainment away from the TV.

But the increasing connectedness of televisions isn’t increasing their ‘share of eyeball’. US consumers in most age-groups increased the proportion of their entertainment time watching video away from the television. This year, those aged 18-24 reported that the majority of their screen entertainment now happens on a computer, tablet or smartphone. TV without the big screen is no longer just a hack to get content online, but an increasingly appealing option.

Cable companies have started to try to address this by producing their own apps. However, they’ve offered a less-than-unified experience, with much of the live and premium content that makes Pay-TV valuable excluded. This year, not a single cable company improved their “satisfaction with cross-device viewing” score and the industry as a whole saw a significant decrease. Conversely, Netflix saw a significant increase in this measure.

Customer Service

“I think if there’s one thing to disrupt in our business, it’s customer service”

May 6, 2014. Neil Smit, President and CEO of Comcast Cable

The cable companies have a problem with customer service. It was the main reason that Comcast are ‘The Worst Company in America’. They’re notorious for trying to make it impossible to cancel a subscription, and their reps have gone out of their way to insult their own customers. Even by the estimation of the industry’s top lobbyist, it needs to triple it’s efforts.

Cable companies know this too. Comcast recently created the position of EVP of customer experience, filling it with company veteran Charlie Herrin, and a budget of $300 million. So far he’s announced that he’ll be hiring 5,500 new reps, most of those for the call center.

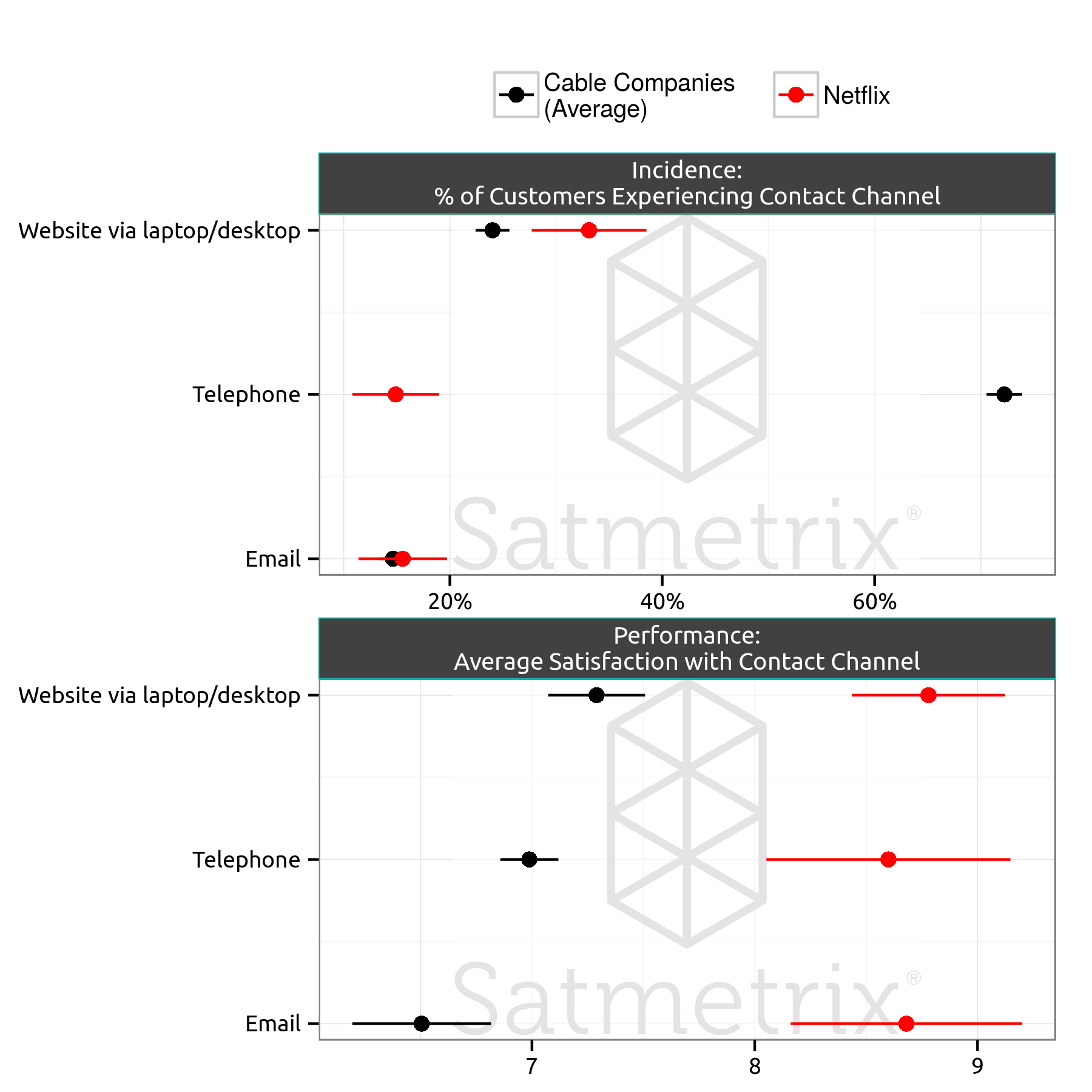

However, he might do better to try and keep his customers off the telephone. Comparing Comcast’s customer service to Netflix is slightly unfair, but we can make some interesting comparisons. Unsurprisingly, Netflix scored significantly higher than Comcast on satisfaction for every contact channel we measured.

More interesting was how often those channels are encountered. Netflix are able to handle substantially more of their contact via the web, a channel that can be efficiently scaled and monitored, with only 15% of customers encountering a call center, compared to the cable industry average of 73%.

Factoring in the incidence rate, as well as satisfaction with drivers is very important. Performance at contact touch-points often have the highest correlation with NPS at the customer level. However, this is because the data comes only from customers who have had to experience some form of support.

In fact, whether customers experience contact at all is often more predictive of loyalty than the difference between the best and worst support reps. While increasing satisfaction at contact touch-points increases loyalty, it’s already been degraded by the customer having to make contact in the first place.

For many technology companies, the core of their service design is not better contact with reps, but rather no contact with reps. This isn’t just a highly effective cost reduction strategy. Customers want services that ‘just work’, and expect to be able to self-serve if required.

Value for Money

“I’m concerned we are reaching a tipping point. Where we begin to price some customers out of the market”

April 29, 2014. Jerald Kent, Chairman & CEO, Suddenlink Communications

The relationship driver with the lowest satisfaction for every cable company was value for money. Looking across the industry, it’s the driver that decreased the most compared to last year.

This isn’t unexpected. Cable bills have been increasing at multiples of the rate of inflation for years, and are now 30% higher than they were in 2010.

Satisfaction with value for money has been decreasing annually for the cable companies, but they may have found the inflection point in price sensitivity – this year’s drops were the largest to date.

What does this all mean for your business?

Focus on what matters to your customers

These critical issues have been the same for years, because they haven’t been the subject of corporate focus.

It’s hard to think of a major cable provider that hasn’t spent considerable resources on an acquisition deal with another local infrastructure monopoly. Most of that energy has been wasted, in no small part because regulators perceive it to be bad for the consumer. In short, the primary industry focus has been rent-seeking. Many of these companies haven’t just been failing to innovate, they’ve been using monopoly power to stifle and even block competing services.

In some parts of the industry, things are starting to change. Dish are the first company to break the industry practice of making consumers pay for equipment prevented from playing Netflix and Hulu. They’re are also the first to offer a serious ‘micro bundle’ offering, in the form of Sling TV, a cross-device app which offers live content (complimentary to an on-demand service) from a smaller number of high-quality channels – crucially including ESPN. It will be interesting to see how SlingTV fares in the 2016 NPS benchmarks!

Work on incidence, not just performance

While they may not know it, often customers want to be profitable. Many of the things which degrade loyalty also increase a customer’s cost to serve. While it’s important to measure satisfaction for divergent customer experiences (such as support) it’s often more important to work on customer experience design that eliminates avoidable contact.

Take Stragetic Action

It can be tempting to look at where these companies find themselves, and see Netlfix’s position as a lucky bet on the way technology evolved. The truth is that these changes have been on the horizon for some time. It’s just that the cable companies have been unwilling to change the way they do business.

For all their talk of shiny new tech, the total R&D spend of Comcast is still too small to even show up in their annual report. But in 2013 they still found $18M for lobbying, and $3 billion for advertising. Netflix’s revenue is only about 7% of Comcast’s, but they invested $472M in R&D last year - around 4x their US ad spend.

The customer experience has always been a competitive advantage. It may be that cable companies are only beginning to realize that they’re competing at all.